A will is a vital legal document that outlines how a person’s assets and affairs should be managed after their death. It serves as a roadmap for loved ones, ensuring that specific wishes regarding property distribution, guardianship of minors, and even funeral arrangements are honored. Understanding what a will entails can help individuals make informed decisions about their legacy.

Many people mistakenly believe that only the wealthy need a will, but it’s an essential tool for anyone wanting to maintain control over their estate. Without a will, state laws dictate how assets are divided, which may not align with an individual’s intentions. By exploring the key components and benefits of having a will, individuals can take proactive steps to secure their family’s future.

What Is a Will?

A will is a legal document that outlines an individual’s wishes regarding the distribution of their assets after death. It specifies how property, money, and other belongings should be allocated. Additionally, a will designates guardians for minor children, ensuring their care and upbringing according to the testator’s preferences.

Wills include critical components such as:

- Testator: The individual who creates the will.

- Executor: The person appointed to carry out the terms of the will.

- Beneficiaries: Individuals or entities designated to receive assets.

- Guardianship Provisions: Specify care for minor children or dependents.

Creating a will provides clarity and direction, allowing for personal wishes to be honored. It prevents state laws from dictating asset distribution, which may not align with a person’s desires. By being proactive in establishing a will, individuals maintain control over their estate and ease the burden on their loved ones during a difficult time.

Types of Wills

Wills can vary based on their purpose and the needs of the testator. Understanding the different types helps in selecting the right format for one’s circumstances.

Simple Will

A simple will is the most straightforward type of will, suitable for individuals with uncomplicated estates. It specifies how assets will be distributed upon death and may designate guardians for minor children. Simple wills typically include basic provisions and are often completed without the need for extensive legal guidance. They ensure that the individual’s wishes are documented clearly and can be straightforwardly executed.

Testamentary Trust Will

A testamentary trust will creates a trust that only takes effect upon the testator’s death. This type of will allows for detailed management of assets after passing, providing conditions for how and when beneficiaries receive their inheritance. It is especially beneficial for minor children or dependents, as the trust can offer financial protection and control over distributions. Testamentary trust wills can be more complex and often require legal expertise to establish properly.

Living Will

A living will, also known as an advance directive, outlines a person’s preferences regarding medical treatment in case of incapacitation. This document gives instructions about life-sustaining treatment and end-of-life care. Unlike traditional wills, a living will does not distribute assets but serves to guide healthcare decisions when the individual cannot communicate their wishes. Having a living will helps ensure one’s medical preferences are honored, providing peace of mind for both individuals and their families.

Importance of Having a Will

A will significantly impacts an individual’s estate planning. It ensures that specific desires regarding asset distribution and guardianship are respected.

Asset Distribution

A will provides clear instructions on how an individual’s assets should be distributed after death. This includes the allocation of property, financial accounts, and personal belongings. When assets are specified in a will, it prevents disputes among heirs and ensures that the deceased’s wishes are honored. Without a will, state laws apply, which often leads to unintended distributions that may not align with what the deceased intended. Individuals benefit from outlining their wishes, reducing potential conflict and confusion among surviving family members.

Guardianship of Minor Children

A will allows parents to designate guardians for minor children, providing crucial protection and peace of mind. Naming a guardian ensures that children will be cared for by someone trusted if both parents pass away. This decision is vital as it influences children’s upbringing and future welfare. Choosing a guardian through a will eliminates uncertainty and court involvement, ensuring that the selected person understands the parents’ wishes for their children’s care and upbringing.

Common Misconceptions About Wills

Misunderstandings about wills often lead individuals to delay or avoid creating one. Addressing these misconceptions can clarify the importance of having a will.

“I Don’t Have Enough Assets”

Many believe that only those with substantial wealth require a will. This view ignores that a will benefits everyone, regardless of asset size. A will ensures that all property, from bank accounts to personal belongings, is distributed according to one’s wishes. Without a will, state laws dictate distribution, potentially ignoring personal preferences and relationships.

“Wills Are Only for the Elderly”

Another common misconception is that wills are solely for the elderly. In reality, anyone over the age of 18 can create a will. Life events such as marriage, divorce, or having children create an urgency to define one’s wishes regarding asset distribution. Young adults, especially those with dependents or significant assets, should establish a will to safeguard their loved ones and clarify their intentions.

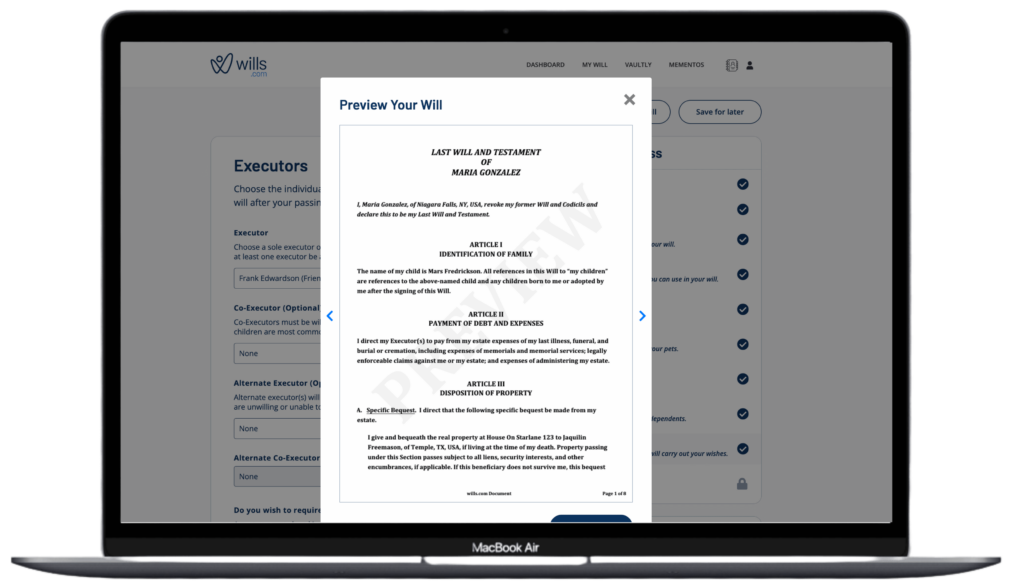

How to Create a Will

Creating a will requires careful consideration and planning. Individuals should understand their options and may benefit from professional guidance in the process.

Choosing the Right Format

Selecting the appropriate format for a will depends on the complexity of an individual’s estate. Key options include:

- Simple Will: Best for individuals with straightforward estates. This type outlines basic distribution plans without intricate provisions.

- Testamentary Trust Will: Suitable for individuals wanting to establish a trust upon their death. This format allows for detailed management of assets and provides for specific conditions.

- Living Will: Ideal for individuals who want to outline their medical treatment preferences in case of incapacitation. This document focuses on healthcare decisions rather than asset distribution.

Determining the right format ensures clarity and aligns the will with personal wishes, enhancing estate planning efficiency.

Consulting Legal Professionals

Consulting legal professionals offers invaluable insights when creating a will. Attorneys can provide:

- Expertise: Legal experts understand state-specific laws and requirements for wills, ensuring compliance and validity.

- Personalized Advice: Professionals can assess individual circumstances and recommend the most suitable will format and provisions tailored to unique needs.

- Drafting Assistance: They can assist in drafting a will that reflects an individual’s intentions accurately, reducing the possibility of disputes.

Utilizing legal services can streamline the creation process and enhance the effectiveness of a will in protecting one’s estate.

Conclusion

Creating a will is a vital step in ensuring that one’s wishes are honored after death. It not only provides clarity on asset distribution but also offers peace of mind regarding the care of minor children. By addressing common misconceptions and emphasizing that everyone can benefit from a will, individuals are encouraged to take control of their estate planning. Consulting with legal professionals can further enhance the process, ensuring the will is comprehensive and legally sound. Ultimately, having a will simplifies complex decisions for loved ones during challenging times, allowing them to focus on healing and remembrance.

Frequently Asked Questions

What is a will?

A will is a legal document that specifies how a person’s assets and affairs should be handled after their death. It outlines the distribution of property, appoints an executor, names beneficiaries, and can designate guardians for minor children.

Why is having a will important?

Having a will is crucial because it allows individuals to maintain control over their estate. It ensures that personal wishes regarding asset distribution, guardianship, and funeral arrangements are respected, preventing state laws from deciding these matters.

Who needs a will?

Everyone over the age of 18 should consider having a will, regardless of their wealth. A will helps ensure that assets are distributed according to one’s wishes and provides guidance for loved ones in difficult times.

What are the different types of wills?

The common types of wills include simple wills, which are straightforward and suitable for uncomplicated estates, testamentary trust wills that establish a trust upon the testator’s death, and living wills that express medical treatment preferences.

How does a will affect estate planning?

A will plays a vital role in estate planning by providing clear instructions for asset distribution and guardianship for minor children. It helps prevent disputes among heirs and ensures that a person’s wishes are honored after death.

Can a will be changed?

Yes, a will can be changed or revoked at any time while the person is alive and has the mental capacity to do so. This flexibility allows individuals to update their will as life circumstances change.

Do I need a lawyer to create a will?

While it’s not strictly necessary, consulting a lawyer is recommended. Legal professionals can offer expert advice, ensure compliance with state laws, and help draft a will that accurately reflects your intentions.

What happens if I die without a will?

If you die without a will, state laws will determine how your assets are distributed, which may not align with your wishes. This can lead to conflicts among heirs and possibly result in your estate being divided in unexpected ways.