The Future of Inheritance: Automation and Legacy

Let’s cut the sugarcoating—life ends the same way for all of us: dead and buried (or flambéed, for you cremation types). And the Baby Boomers? Their curtain call is coming sooner than later. After decades of guzzling coffee, clocking in, and rolling their eyes at Millennials, they’re trading hard hats and corner offices for shuffleboard courts and RV parks. Retirement, baby! But here’s the kicker—after retirement comes the final stop: death.

Now, here’s why you should care. The Boomers are sitting on $81 trillion in real estate, cars, jewelry, businesses, stocks, bonds, crypto, and other goodies. That’s a tsunami of wealth getting ready to flood into your pockets (or, if you’re unlucky, into your least favorite cousin’s pockets). Of course, not all of it will flow smoothly. Family feuds and probate lawyers will make sure of that.

Boomers have one last hurrah before their big goodbye: cruising the highways in diesel pushers, comparing the amenities of Cracker Barrel parking lots, or enjoying water aerobics classes on the Sunshine Coast. But here’s the hard truth: a large percentage of retirees don’t make it long into retirement. It’s as if the universe takes one look at their RV dreams and says, “You’re done here.”

The Dirty Secret of Estate Planning Attorneys

You’d think estate planning attorneys are in the business of helping families pass down wealth smoothly, right? Wrong. Their real cash cow isn’t setting up wills and trusts—that just pays for their morning lattes. The real money’s in probate court, where they charge by the hour to referee your family’s posthumous soap opera.

While you’re busy “blinking for an exceptionally long time”, some suit-wearing lawyer is out there turning your inheritance into their retirement fund. Your will, with its well-intentioned but vague wording (“divide my stuff equally”), has become a goldmine for probate attorneys. They’ll spend hours untangling what you meant versus what you wrote, while coaching your kids through a glorified game of tug-of-war over the family cabin. Spoiler alert: the only winner in probate is the lawyer.

Enter the Future of Inheritance: Automation, Not Aggravation

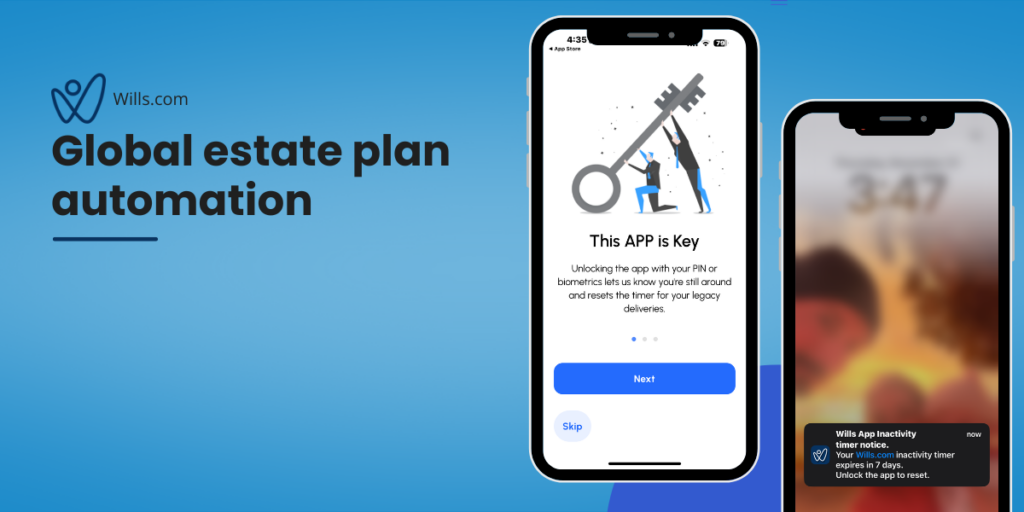

Let’s face it: it’s 2025. Everything is automated—your lights, your doorbell, even your grocery lists. So why isn’t your estate plan? Forget the dusty lawyer’s office and the snail-paced probate process. It’s time to embrace the digital blind discretionary trust.

Here’s how it works:

- You load your legal documents—wills, trusts, transfer-on-death deeds, healthcare directives, DNRs—into a digital framework.

- You assign beneficiaries and executors, decide who gets what, and then your smartphone, the modern extension of your brain (because let’s be real, we’re all cyborgs now), keeps tabs on your well-being.

- If your phone detects you’re not answering its check-ins (“What’s your favorite boy band?” or “What’s 7×8?”), it escalates. Maybe it nudges your designated trustee. Maybe it double-checks your wellness through an AI assistant. And if you fail to respond for too long? Well, congratulations—you’re probably dead.

And that’s when the magic happens:

- Your trust documentation and instructions get delivered to your executor.

- Your will is executed automatically, with an AI chatbot standing by to explain every single detail, leaving no room for misinterpretation.

- Your money? Distributed exactly how you wanted. Lump sum? Done—straight to Venmo. Monthly allowances? Sure, no problem. Want to wait until your kid turns 21 so they don’t blow it on NFTs and tequila? Totally doable.

It’s an estate delivery protocol that handles everything. And you can even leave your loved ones a heartfelt video that starts with: “If you’re watching this, I’m dead. But hey, enjoy the stamp collection!”

Inheritance 2.0

The dusty, drama-filled days of will readings are over. The future is blockchain-secured notifications that tell your heirs exactly what they’re getting—down to the GPS coordinates of the family home. Imagine receiving:

“Congratulations. You’ve inherited House [40.7128° N, 74.0060° W], 2.4 BTC, $15,333 USD, and a 1990 Honda Odyssey.”

Futuristic? Maybe. Possible? Absolutely. And we’re building it now at Wills.com, where the focus is on simplifying inheritance, automating estate plans, and leaving nothing unsaid.

Because the truth is, the Baby Boomers may be passing on, but they’re leaving behind a hell of a legacy. The question is: are you ready to handle it?

– vch