A bequest is more than just a legal term; it represents a powerful act of generosity and legacy. When someone passes on their assets to another through a will, they’re making a lasting impact on the lives of those they care about. Understanding the nuances of bequests can help individuals navigate their own estate planning or honor the wishes of loved ones.

In an ever-changing world, the significance of bequests often gets overshadowed by immediate financial concerns. Yet, these gifts can provide security and support for future generations. By defining bequest clearly, individuals can appreciate its role in shaping financial legacies and fostering connections beyond one’s lifetime.

Understanding Bequest

Bequest refers to the process of transferring assets or property after an individual’s death, typically through a will. It represents a significant aspect of estate planning that ensures one’s wishes are honored.

Definition of Bequest

A bequest is a provision in a will that designates specific assets or property to be distributed to beneficiaries upon the testator’s death. This form of inheritance can include money, real estate, personal belongings, and other valuables. The individual making the bequest is known as the testator, while the recipients are referred to as beneficiaries. A well-structured bequest provides clarity and guarantees that the testator’s intentions are fulfilled.

- Specific Bequest: A specific bequest directs particular assets to a designated beneficiary, such as a car, artwork, or jewelry. These items are clearly identified within the will.

- General Bequest: A general bequest involves a quantity of money or property without specifying a particular asset. For example, leaving $10,000 to a charity falls into this category.

- Residuary Bequest: A residuary bequest allocates the remaining assets in an estate after all debts, taxes, and specific bequests have been fulfilled. This ensures that any leftover property or funds are distributed according to the testator’s wishes.

- Contingent Bequest: A contingent bequest takes effect only when a specific condition is met, such as a beneficiary reaching a certain age or surviving the testator. This type of bequest provides a safeguard that aligns asset distribution with the testator’s criteria.

- Demonstrative Bequest: A demonstrative bequest combines aspects of specific and general bequests, where a specific sum is used to determine the source of payment. For example, leaving $5,000 to a friend from a specific bank account qualifies as a demonstrative bequest.

Understanding these types of bequests assists individuals in effective estate planning, ensuring their financial legacies reflect their intentions.

Importance of Bequest

Bequests serve as a vital component in estate planning, allowing individuals to ensure their wishes are honored after their passing. Understanding their significance supports both personal legacy planning and the financial security of beneficiaries.

Legal Implications

Bequests carry substantial legal weight, entailing specific procedures to enforce the wishes outlined in a will. Valid bequests require adherence to state laws regarding wills and estate administration. An executor, appointed by the deceased, oversees the distribution of assets according to the terms of the will. Disputes may arise over the interpretation of bequests, necessitating clear language to avoid confusion. Failing to follow legal formalities can invalidate a bequest, potentially leading to unintended asset distribution according to intestacy laws.

Tax Considerations

Bequests can influence the overall tax burden of both the estate and the beneficiaries. Federal estate tax applies to estates exceeding $12.92 million in 2023, with rates ranging from 18% to 40%. Proper planning can minimize tax liabilities, such as leveraging lifetime gifts or establishing trusts. Beneficiaries may also face income tax on certain bequeathed assets, particularly if those assets generate income. Thus, understanding tax implications aids in maximizing the value of a bequest for future generations.

How to Create a Bequest

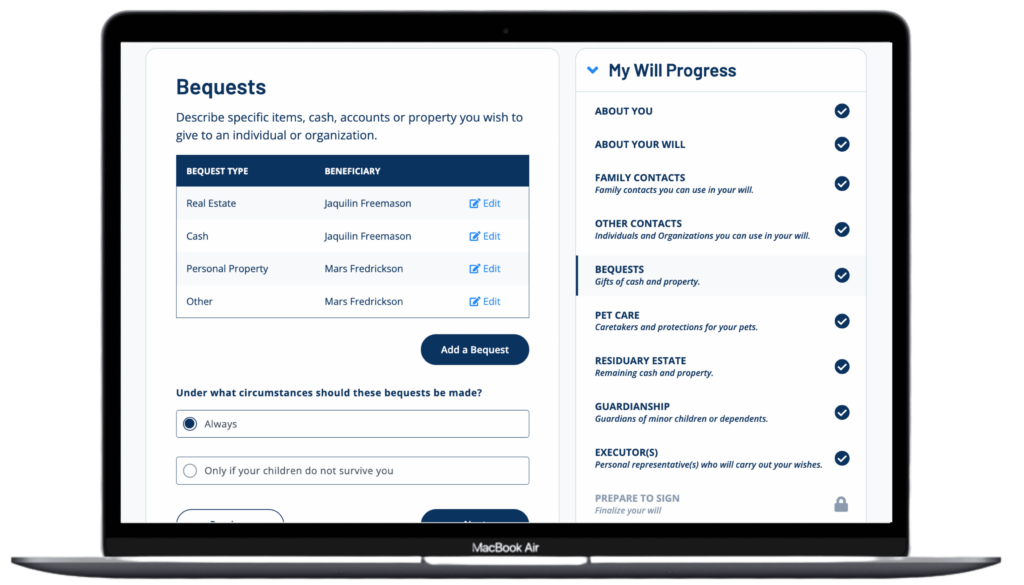

Creating a bequest involves specific steps to ensure clarity and legality in asset distribution. Proper planning leads to fulfilling one’s wishes and securing beneficiaries’ financial futures.

Writing a Will

Writing a will serves as a foundational step for creating a bequest. Clear, concise language within the will articulates intentions regarding asset distribution. Individuals should:

- Identify Assets: List all assets, including real estate, bank accounts, and personal property.

- Specify Bequests: Clearly state specific and general bequests, designating how assets transfer.

- Appoint an Executor: Select a trustworthy individual to manage the estate and ensure the will’s execution.

- Adhere to Legal Requirements: Ensure the will complies with state laws, which may include witnessing and notarization.

Designating Beneficiaries

Designating beneficiaries is crucial for effective bequest planning. This step ensures that the intended individuals receive specific assets. Guidelines include:

- Choose Primary and Secondary Beneficiaries: Identify who will receive assets first and designate alternate beneficiaries in case the primary ones cannot inherit.

- Clarify Shares: Specify how much each beneficiary receives, preventing ambiguity.

- Update Designations Regularly: Review and amend beneficiary designations following major life events, such as marriage or divorce, to reflect current intentions.

- Communication: Discuss these designations with beneficiaries to prepare them for future inheritance and avoid surprises.

Implementing these steps ensures bequests properly fulfill an individual’s legacy and uphold their last wishes.

Common Misconceptions About Bequest

Understanding bequests involves clarifying myths surrounding them. Misconceptions can lead to misunderstandings that affect estate planning.

Myth vs. Reality

- Myth: A bequest requires a large estate.

Reality: Bequests can involve any asset, regardless of value. They help individuals create legacies, whether donating small items or substantial wealth. - Myth: Bequests are only for wealthy individuals.

Reality: Anyone can make a bequest. Assets like personal belongings, financial accounts, and real estate can become bequests, making them accessible to all. - Myth: Bequests automatically transfer assets without a will.

Reality: A valid will is essential for enforcing bequests. Without it, state laws determine asset distribution, which may not align with an individual’s wishes. - Myth: All bequests incur high taxes for beneficiaries.

Reality: While some bequests may be subject to estate taxes, many fall below certain tax thresholds. Proper planning can help minimize tax implications for beneficiaries.

- What happens if a bequest is contested?

Courts may resolve disputes related to bequests. If disputes arise, they often involve proving the will’s validity or challenging the distribution process.

- Can bequests include digital assets?

Yes, digital assets like online accounts and cryptocurrencies can be included. Specifying these in a will ensures they are properly handled.

- What if a named beneficiary predeceases the testator?

Contingent bequests may apply. If a beneficiary dies before the testator, their share can be allocated to an alternate beneficiary specified in the will.

- Is it necessary to update a bequest regularly?

Yes. Life events such as marriage, divorce, or the birth of a child necessitate updates to ensure that a bequest aligns with current intentions.

Conclusion

Bequests serve as vital instruments in shaping one’s legacy and ensuring that wishes are honored after death. They offer a structured way to transfer assets and provide financial security to loved ones. By understanding the various types of bequests and the steps involved in creating them, individuals can make informed decisions that reflect their intentions.

Effective estate planning not only safeguards financial legacies but also fosters connections that endure beyond a person’s lifetime. Regularly updating bequests in response to life changes is essential for maintaining clarity and legality. Ultimately, embracing the concept of bequests empowers individuals to leave a meaningful impact on future generations.

Frequently Asked Questions

What is a bequest?

A bequest is the act of transferring assets or property after someone’s death, typically through a will. It allows individuals to leave their assets to specific beneficiaries, ensuring their wishes are honored.

What are the types of bequests?

The main types of bequests include specific bequests, general bequests, residuary bequests, contingent bequests, and demonstrative bequests. Each type serves a different purpose in estate planning and asset distribution.

Why are bequests important in estate planning?

Bequests are crucial for ensuring that your financial legacy reflects your intentions and that your loved ones are financially secure after your passing. They promote thoughtful planning and help avoid disputes over assets.

How do I create a bequest?

To create a bequest, you should write a will, identify your assets, specify your bequests, and appoint an executor. Regularly updating your will after major life events is also essential to keep your plans current.

Can anyone create a bequest?

Yes, anyone can create a bequest regardless of their estate’s size. A valid will is necessary to enforce bequests, allowing individuals from all financial backgrounds to pass on their assets.

Are there tax implications for bequests?

Yes, bequests can impact estate taxes and beneficiaries’ tax liabilities. However, proper planning can minimize these tax implications, maximizing the value of the bequests.

What if my bequest is contested?

If a bequest is contested, it may lead to legal disputes and potential delays in asset distribution. It’s vital to have clear language in your will and consult legal professionals if needed.

Should I include digital assets in my bequest?

Yes, digital assets like online accounts and currencies should be included in your bequest. Clearly outline how you want these assets managed or transferred to beneficiaries in your will.

How often should I update my bequests?

You should regularly update your bequests, especially after major life events like marriage, divorce, or the birth of a child. This ensures your wishes remain relevant and accurately reflect your current situation.

What common misconceptions exist about bequests?

Common misconceptions include that bequests are only for wealthy individuals or that all bequests incur high taxes. In reality, anyone can make bequests, and proper planning can reduce tax impacts.